ESG: THE NEW MUST-HAVE IN THE DUE DILIGENCE PROCESS

24.06.2021

When presenting a startup to investors or clients, founders usually know the required checklist.

But there is a rather new factor in town, and it’s called ESG.

ESG, which was once a parameter only impact investors took into consideration, is becoming more and more interesting to almost all stakeholders.

What is ESG? It is a combination of environmental, social, and governance criteria, a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Today companies from all verticals are including their impact on the environment in their reports. There is no standard or regulation for the reports but it is still highly important to include it because of the growing trend of diverting investments to sustainable companies with ESG awareness.

Environmental criteria consider how a company performs as a steward of nature. It includes assessing a company’s interdependencies with climate change, pollution, biodiversity, or water, and the related risk-mitigation strategies.

Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. In addition, it investigates product safety, working conditions, and employee diversity.

Governance covers topics such as executive compensation, accounting practice, board structure, and business ethics.

Today markets are undergoing a profound transformation as investors factor in the implications of climate change and other sustainable themes. Changing social values, accelerated regulatory pressure, growing investment opportunities, and risk management are all underpinning client demand for implementing ESG criteria in order to invest with related to certain values and purpose.

More than 180 CEOs in the USA’s largest companies have pledged to incorporate social and environmental goals going forward. The business purpose is no longer return for shareholders, but value creation for all stakeholders- the views in the long-running debate have shifted. In addition, there is the effect of raising awareness overall. Investors are increasingly asking, how can I contribute towards making the world a better place?

That shift towards a sustainable world has prompted a need for increased transparency, along with better disclosure and data around sustainable-related goals and metrics. There is also a new need for an analytical approach that utilizes non-financial information to help investors understand the entire story of a company and make their decisions.

Size of the ESG Market and Growth

Investors are looking to incorporate environmental, social, and governance (ESG) considerations into their investment process. That provides another layer to become a significant tool in recent years, benefiting from large-scale fundraising from investment houses and institutional investors around the world. The new generation of investors have a new awareness of the environmental and social impact and they are looking for investments that do not have a negative impact.

Sustainable investing, for example, has been one of the fastest-growing areas in finance for several years. At the end of 2020, global sustainable funds under management reached an all-time high of 1.65 trillion.

Seven out of 10 investors want to invest in companies that have positive social impact and good environmental record, and 65% of institutional investors believe ESG will become an industry-standard within the next 5 years, according to a survey conducted by Natixis investment managers. By asset class, equity has the largest share of assets managed under ESG criteria, which represents an over-proportional wight.

The exact size of the ESG market is hard to quantify, given the different definitions of what should be included. The Global Sustainable investment alliance estimates the market size at $30.7 Trillion, in 2010 it was below $10 Trillion

Institutional investors dominate the ESG market but we can see more and more demand from retail investors as well which we think this trend will continue.

To understand the strong connection between ESG and companies’ performance, it is interesting to read a significant study that was done at Oxford University. The researchers have found out that 88% of companies with strong substantiality practice demonstrate better operational performance, which ultimately translates into cash flows. 80% of the studies show that equity performance is positively influenced by good sustainability practice. (Oxford University, 2018)

Bankruptcy Risk

Studies found that if an investor were to consider ranking on ESG factors at least 5 years before the bankruptcy and only bought stocks with above-average scores on Environmental and social metrics, the investor would have avoided fifteen of the seventeen companies that filed for bankruptcy.

Moreover, the average ESG scores one year before the date that the company filed for bankruptcy were quite low driven by effective forecasting from the ESG factors scores.

How can investors learn about companies’ ESG status?

As ESG considerations making their to the heart of mainstream investing, there are several ways investors get the needed information such as periodic ratings and reports.

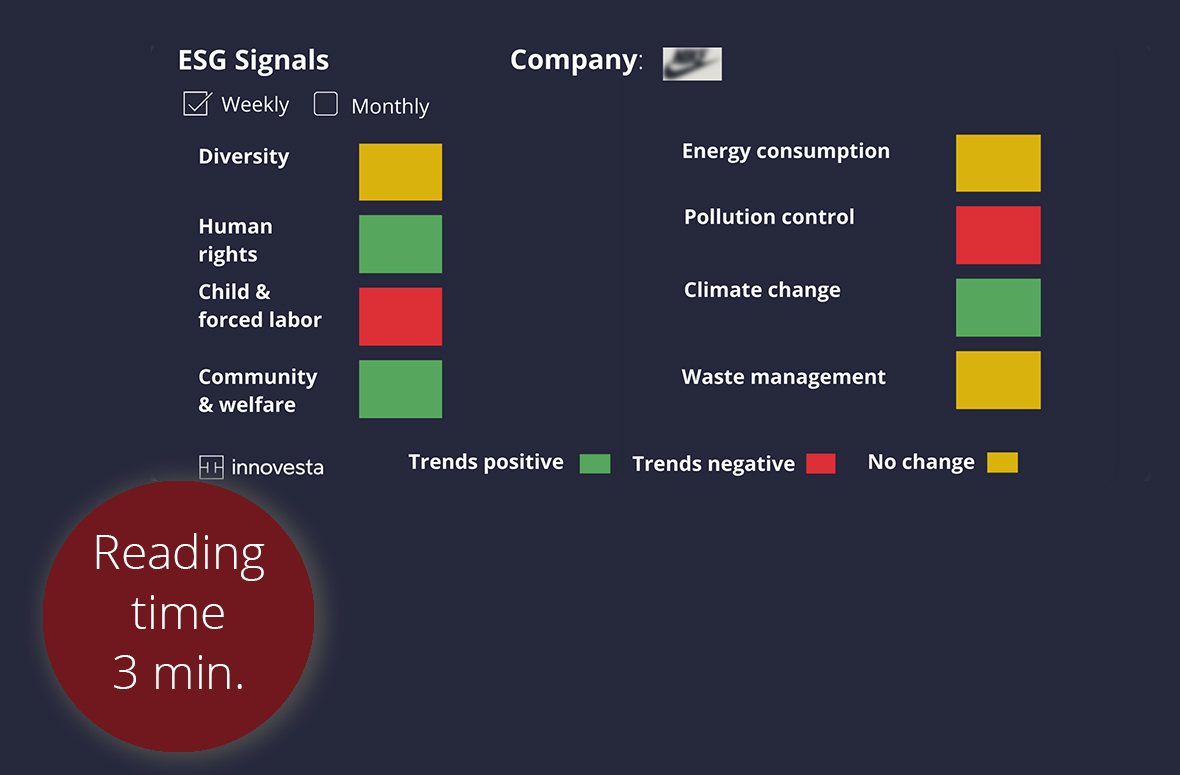

Innovesta, an Israeli AI Fintech company that developed an end-to-end AI based Signal Factory, is taking the lead in correlating millions of data sources to reveal the hidden stories behind private and public companies. The ongoing tracking of news and social media mentions, sentiment analysis and amart compare, is now including insights, alerts and signals, related directly to the ESG attributes.

The Innovesta real-time signals allow investment organizations and procurement departments to make better business decisions.

Want to know how your company is doing according to the ESG factors?

Ytech Runway invites you to get the Innovesta signals. Sign up here https://ytechrunway.innovesta.co/

But there is a rather new factor in town, and it’s called ESG.

ESG, which was once a parameter only impact investors took into consideration, is becoming more and more interesting to almost all stakeholders.

What is ESG? It is a combination of environmental, social, and governance criteria, a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Today companies from all verticals are including their impact on the environment in their reports. There is no standard or regulation for the reports but it is still highly important to include it because of the growing trend of diverting investments to sustainable companies with ESG awareness.

Environmental criteria consider how a company performs as a steward of nature. It includes assessing a company’s interdependencies with climate change, pollution, biodiversity, or water, and the related risk-mitigation strategies.

Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. In addition, it investigates product safety, working conditions, and employee diversity.

Governance covers topics such as executive compensation, accounting practice, board structure, and business ethics.

Today markets are undergoing a profound transformation as investors factor in the implications of climate change and other sustainable themes. Changing social values, accelerated regulatory pressure, growing investment opportunities, and risk management are all underpinning client demand for implementing ESG criteria in order to invest with related to certain values and purpose.

More than 180 CEOs in the USA’s largest companies have pledged to incorporate social and environmental goals going forward. The business purpose is no longer return for shareholders, but value creation for all stakeholders- the views in the long-running debate have shifted. In addition, there is the effect of raising awareness overall. Investors are increasingly asking, how can I contribute towards making the world a better place?

That shift towards a sustainable world has prompted a need for increased transparency, along with better disclosure and data around sustainable-related goals and metrics. There is also a new need for an analytical approach that utilizes non-financial information to help investors understand the entire story of a company and make their decisions.

Size of the ESG Market and Growth

Investors are looking to incorporate environmental, social, and governance (ESG) considerations into their investment process. That provides another layer to become a significant tool in recent years, benefiting from large-scale fundraising from investment houses and institutional investors around the world. The new generation of investors have a new awareness of the environmental and social impact and they are looking for investments that do not have a negative impact.

Sustainable investing, for example, has been one of the fastest-growing areas in finance for several years. At the end of 2020, global sustainable funds under management reached an all-time high of 1.65 trillion.

Seven out of 10 investors want to invest in companies that have positive social impact and good environmental record, and 65% of institutional investors believe ESG will become an industry-standard within the next 5 years, according to a survey conducted by Natixis investment managers. By asset class, equity has the largest share of assets managed under ESG criteria, which represents an over-proportional wight.

The exact size of the ESG market is hard to quantify, given the different definitions of what should be included. The Global Sustainable investment alliance estimates the market size at $30.7 Trillion, in 2010 it was below $10 Trillion

Institutional investors dominate the ESG market but we can see more and more demand from retail investors as well which we think this trend will continue.

To understand the strong connection between ESG and companies’ performance, it is interesting to read a significant study that was done at Oxford University. The researchers have found out that 88% of companies with strong substantiality practice demonstrate better operational performance, which ultimately translates into cash flows. 80% of the studies show that equity performance is positively influenced by good sustainability practice. (Oxford University, 2018)

Bankruptcy Risk

Studies found that if an investor were to consider ranking on ESG factors at least 5 years before the bankruptcy and only bought stocks with above-average scores on Environmental and social metrics, the investor would have avoided fifteen of the seventeen companies that filed for bankruptcy.

Moreover, the average ESG scores one year before the date that the company filed for bankruptcy were quite low driven by effective forecasting from the ESG factors scores.

How can investors learn about companies’ ESG status?

As ESG considerations making their to the heart of mainstream investing, there are several ways investors get the needed information such as periodic ratings and reports.

Innovesta, an Israeli AI Fintech company that developed an end-to-end AI based Signal Factory, is taking the lead in correlating millions of data sources to reveal the hidden stories behind private and public companies. The ongoing tracking of news and social media mentions, sentiment analysis and amart compare, is now including insights, alerts and signals, related directly to the ESG attributes.

The Innovesta real-time signals allow investment organizations and procurement departments to make better business decisions.

Want to know how your company is doing according to the ESG factors?

Ytech Runway invites you to get the Innovesta signals. Sign up here https://ytechrunway.innovesta.co/