Is It All For One, And One For All? The Importance of Having a Founders Agreement

12.12.2022

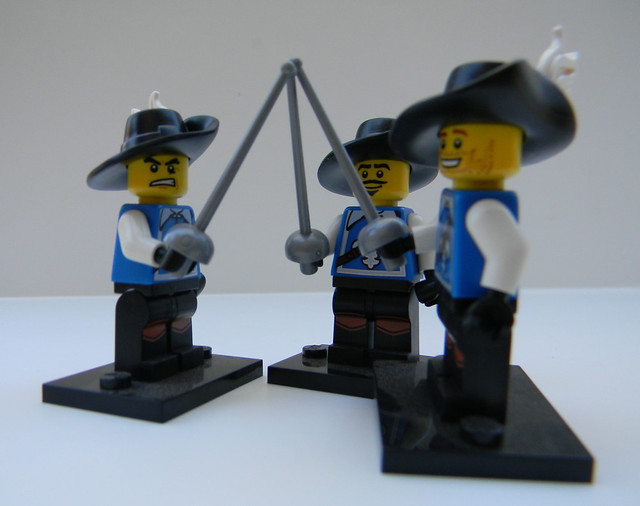

So, these three friends, Athos, Aramis, and Porthos have this wonderful idea they’ve been cooking since they’ve finished their senior year in the university of the Guard and can’t wait to get working on it for real and incorporate their future billion-dollar company. They have several potential investors in the pipeline, and they are, in their most humble opinion, ready to go.

And yet, before they rush into the beautiful mess of running their start-up, and bringing in additional players into their field, I wish to take a second to emphasize the importance of putting their basic understandings between them in writing.

In modern days, we call this a “Founders Agreement”. This is basically an agreement between the founders themselves and the company, whether already existing or destined to be established in the future. It includes certain rights and obligations that apply to everyone starting from day 1 (and sometimes, even before that), regardless of the choice of establishment or place of business.

The Basic Four W’s (who, what, where, and why)

So, dearest musketeers, what exactly is your purpose? Do you and your partners understand the business of your proposed company thoroughly, and do you know where and how you want to set it up?

Usually, the recitals of a founders agreement, together with the first few sections, intend to settle just that. They set forth who the founders are, and what the company’s business shall be, together with the proposed name of the Company. They further state that the founders wish to set up a company under specific terms and understandings (why) and include the intended jurisdiction under which it shall be incorporated and the location of where the company shall operate and run its business.

Roles in the Company and Devotion of Time

Sometimes Founders can be under the impression that they will all share the work amongst themselves, and that everyone will be doing “everything”; there is no need for dividing the responsibilities between them (who doesn’t need three CEOs?). Another scenario would be defining roles that don’t necessarily require the same amount of work from each of them and have different workloads at different times. This may cause the other two to wonder what the third one is actually doing in the company since there is no product to actually market and sell at this time. Try to be precise; granted that things are fluid and will change over time, but initially, there should be a CEO, a CTO, and someone on the business and marketing side, all depending on what the start-up actually does.

Although you and your team won’t all be at the same point in your life, it is important to synchronize your ability to commit to the company as much as possible or at least to very openly align expectations among you. If one is still working a full-time job, or part-time in a different start-up, it will be hard to keep him or her engaged in the long run. Furthermore, this might lead to dividing the percentages of holdings in a manner that reflects short-term commitment post-incorporation, which may ultimately lead to not having everyone on board. Why should Athos work as hard as Porthos, if he holds only 13% of the Company? Try to see if, when taking into account the years of commitment expected from you assuming the company succeeds (and not just the next few months), you can divide the holdings equally between you, understanding that its best that your team is tight and has had enough past experience together keeping things glued.

Decision Making in the Company

Next, the agreement will determine the decision-making process in the Company. Whereas most of the decisions, whether brought to the founders as shareholders or as board members (they are likely to initially occupy both positions) will usually by default require a majority vote for such resolution to pass, there are some issues that you might want to be resolved with unanimous support. Such decisions can initially include financing or selling the company at a certain valuation that the founders agree to be lower than their expectations, a material change of the company’s business, or dissolving the company entirely; other "veto rights" depend on your team and the decisions that are important to you. The important thing to remember is not to overdo this list of major decisions so that it won’t create a lock-down on the company and its operations. The majority should hold most of the power if not all of it and if decisions are consistently made against the opinion of one specific founder, the best is for that founder to understand that it's time for him or her to leave.

Intellectual Property, Confidentiality and Non-Compete

One of the most important provisions of the Founders Agreement sets out to make sure that any and all of the intellectual property that each of the founders creates, or has brought into the company’s technology, shall belong to the company. Regardless of whether one leaves or stays in the company, we want the company’s most important assets – like its know-how, trademarks, patents, and patents applications – to be vested in the company, as this is a huge part of the company’s value. This is one of the major things investors look for, and although you can sign similar undertakings along the way, having this clause from day 1, which applies to each of the Founders, is the way to do it. This clause will usually include a paragraph on confidentiality, making sure each of the Founders keeps confidential the information that he is exposed to throughout his engagement in the company (and thereafter). In addition, you have the option of including a non-compete clause that determines that none of the musketeers compete with the company’s business and use all of what they learned from the company in order to open their own group of musketeers (which we’ve all seen happen before).

Reverse Vesting and Repurchase Right

One too many times, the “three inseparable” have claimed: “I trust him” “we are best friends” “there’s no way that’s going to happen – none of us are backing out”.

Indeed, at the beginning of a startup’s life, everyone is excited about building the next Lemonade, AppsFlyer, or Fiverr. And yet, it should not be of news to them that startup life carries with it significant risk. Many examples have shown how a founder can leave even after a few short months. In fact, close to 40% of companies experience the loss of a founder. This can be for many reasons: group quarrel, personal reasons or even simply receiving a better offer somewhere else. Why should the departing party leave with one-third of the Company’s shares, just before you even had a chance to do anything? This situation may cause a range of difficulties starting from making basic decisions in the company (trying to chase someone who is no longer an active part of the company but is still needed to vote in certain matters of the board or general meeting) to being unattractive to investors (trying to explain who the third person in the cap table is and why he is no longer with us but holds a third of the company’s share interest).

Having said that, promise yourself that when the time comes, you will be ready to let go of a fellow musketeer which turns out is not a good fit for the startup. I am not telling you this in order to scare you out of working with your fellow musketeers or embarking on your journey, but it's best to wrap your head around the basic and unfortunate notion that someone is bound to leave and that everyone is on the same page concerning this scenario.

On a practical level, there is a simple solution for all of this which is known as a “Reverse Vesting” or “Repurchase Right” clause in the founder's agreement. The concept of vesting for founders’ shares, is that they will receive or rather "earn" their shares over time. Although each will have the right to 100% of the shares upon incorporation, in the event they choose to leave before the determined vesting schedule, the company or the other founders shall have the “repurchase right” to purchase their shares (for a very symbolic consideration). The importance of setting this out so early on in time is to avoid any tax events that may occur later on due to the transfer of the shares, once the company has already gained certain value. Not to mention, this helps avoid unwanted disputes and claims from departing founders – since you all agreed on this from day one before the shares were had any real value.

The purpose is to provide each of the founders with an incentive to continue and help your startup succeed, and if not, keep the company safe from future deadlock. If a founder chooses to leave before his shares became fully vested according to the determined schedule, then accordingly, he or she shall leave with the number of shares he or she “deserves” for the time actually spent. The rest of the shares are then transferred back to the Company or pro-rata to the founders.

Standard vesting schedules are usually between 3-4 years and may or may not include a one-year “cliff” from the date of the agreement, which until then, none of the shares vest. If a cliff is included, then following the cliff, a certain portion -usually the pro-rata share of the time that passed out of the total period - vests, and thereafter, the remaining shares vest over the next 2-3 years, in a monthly or quarterly linear fashion. Should one of you leave along the way (who knows, maybe Google will poach you – hey, we get it, or maybe this just isn't your thing being an entrepreneur) the repurchase will be exercised, leaving you to peacefully back away from your shares, and make room for your successors.

There are different approaches to this matter, which differentiate based on the various reasons for the founder no longer being with us. We, however, would recommend the most aggressive reverse vesting scheme settled between you, so that if a founder leaves or is let go – for any reason whatsoever – the company or remaining shareholders can exercise the repurchase right and take your shares that have not yet vested. This means that no matter what horrible event occurred; the unvested shares are being returned. Why should you lose twice from a horrible situation in which one founder finds death or disability, and they receive another extra portion of shares (you are still stuck in a situation where he holds too much equity)? In another complex situation, the founder leaves as he feels like he is a fifth wheel and the other two are ganging up against him. In many ways may feel like he is being "bullied" professionally, and the other founders getting "extra" shares from him upon his departure is unfair. To that, we also say nay. He should return the rest of his shares. In our experience, if the reason for the departure of a founder has bearing on the number of shares he or she will remain with, this reason will be disputed in real-time and no path to a definitive outcome will be available for the company, which could lead to its demise. Having a clear-cut arrangement is in your favor. You need an easy and simple tool, to be able to save the surviving founders in this event, from any situation. This is truly the meaning of taking one for the team: a founder should be able to sincerely agree to move aside and sacrifice his or her equity if the time comes, for the sake of the company.

Also, general tip on a human factor level. Work on your character judgment and try exercising your emotional intelligence by recognizing the types of people you should work with, and others you should not.

And having said all of that, note that once you encounter your first investors, this agreement most likely is terminated or heavily amended. Thus, and mostly for the repurchase right we discussed above, there should be no reason not to execute the agreement and “forget about it” until (sadly) one of the musketeer's leaves, or (happily) when your investor requests to terminate it. As Alexandre Duma would conclude:

“And now, gentlemen […] All for one, one for all--that is our motto, is it not?”

“And yet--” said Porthos.

“Hold out your hand and swear!” cried Athos and Aramis at once.

Overcome by example, grumbling to himself, nevertheless, Porthos stretched out his hand, and the four friends repeated with one voice the formula dictated by d’Artagnan:

“All for one, one for all.”

“That’s well! Now let us everyone retire to his own home...”

The Founders Agreement is an important agreement that can have serious implications for the founders and the company's ability to grow and succeed. If you indeed intend on operating on an all for one, and one for all basis, we strongly recommend that you enter into a Founders Agreement before you embark on your adventure. You can find a template for such an agreement here. This template is offered as-is and does not constitute legal advice, and we strongly recommend that you consult with a lawyer before entering into a founders agreement.

Shine Shaham is an associate in Yigal Arnon & Co.’s high-tech practice. Shine's practice focuses on the representation of high-tech startup companies as well as established corporations, venture capital funds, private investors, technological incubators, and multinational companies, with an emphasis on private equity financings, commercial transactions, corporate governance, strategic investments and mergers, and acquisitions.

And yet, before they rush into the beautiful mess of running their start-up, and bringing in additional players into their field, I wish to take a second to emphasize the importance of putting their basic understandings between them in writing.

In modern days, we call this a “Founders Agreement”. This is basically an agreement between the founders themselves and the company, whether already existing or destined to be established in the future. It includes certain rights and obligations that apply to everyone starting from day 1 (and sometimes, even before that), regardless of the choice of establishment or place of business.

The Basic Four W’s (who, what, where, and why)

So, dearest musketeers, what exactly is your purpose? Do you and your partners understand the business of your proposed company thoroughly, and do you know where and how you want to set it up?

Usually, the recitals of a founders agreement, together with the first few sections, intend to settle just that. They set forth who the founders are, and what the company’s business shall be, together with the proposed name of the Company. They further state that the founders wish to set up a company under specific terms and understandings (why) and include the intended jurisdiction under which it shall be incorporated and the location of where the company shall operate and run its business.

Roles in the Company and Devotion of Time

Sometimes Founders can be under the impression that they will all share the work amongst themselves, and that everyone will be doing “everything”; there is no need for dividing the responsibilities between them (who doesn’t need three CEOs?). Another scenario would be defining roles that don’t necessarily require the same amount of work from each of them and have different workloads at different times. This may cause the other two to wonder what the third one is actually doing in the company since there is no product to actually market and sell at this time. Try to be precise; granted that things are fluid and will change over time, but initially, there should be a CEO, a CTO, and someone on the business and marketing side, all depending on what the start-up actually does.

Although you and your team won’t all be at the same point in your life, it is important to synchronize your ability to commit to the company as much as possible or at least to very openly align expectations among you. If one is still working a full-time job, or part-time in a different start-up, it will be hard to keep him or her engaged in the long run. Furthermore, this might lead to dividing the percentages of holdings in a manner that reflects short-term commitment post-incorporation, which may ultimately lead to not having everyone on board. Why should Athos work as hard as Porthos, if he holds only 13% of the Company? Try to see if, when taking into account the years of commitment expected from you assuming the company succeeds (and not just the next few months), you can divide the holdings equally between you, understanding that its best that your team is tight and has had enough past experience together keeping things glued.

Decision Making in the Company

Next, the agreement will determine the decision-making process in the Company. Whereas most of the decisions, whether brought to the founders as shareholders or as board members (they are likely to initially occupy both positions) will usually by default require a majority vote for such resolution to pass, there are some issues that you might want to be resolved with unanimous support. Such decisions can initially include financing or selling the company at a certain valuation that the founders agree to be lower than their expectations, a material change of the company’s business, or dissolving the company entirely; other "veto rights" depend on your team and the decisions that are important to you. The important thing to remember is not to overdo this list of major decisions so that it won’t create a lock-down on the company and its operations. The majority should hold most of the power if not all of it and if decisions are consistently made against the opinion of one specific founder, the best is for that founder to understand that it's time for him or her to leave.

Intellectual Property, Confidentiality and Non-Compete

One of the most important provisions of the Founders Agreement sets out to make sure that any and all of the intellectual property that each of the founders creates, or has brought into the company’s technology, shall belong to the company. Regardless of whether one leaves or stays in the company, we want the company’s most important assets – like its know-how, trademarks, patents, and patents applications – to be vested in the company, as this is a huge part of the company’s value. This is one of the major things investors look for, and although you can sign similar undertakings along the way, having this clause from day 1, which applies to each of the Founders, is the way to do it. This clause will usually include a paragraph on confidentiality, making sure each of the Founders keeps confidential the information that he is exposed to throughout his engagement in the company (and thereafter). In addition, you have the option of including a non-compete clause that determines that none of the musketeers compete with the company’s business and use all of what they learned from the company in order to open their own group of musketeers (which we’ve all seen happen before).

Reverse Vesting and Repurchase Right

One too many times, the “three inseparable” have claimed: “I trust him” “we are best friends” “there’s no way that’s going to happen – none of us are backing out”.

Indeed, at the beginning of a startup’s life, everyone is excited about building the next Lemonade, AppsFlyer, or Fiverr. And yet, it should not be of news to them that startup life carries with it significant risk. Many examples have shown how a founder can leave even after a few short months. In fact, close to 40% of companies experience the loss of a founder. This can be for many reasons: group quarrel, personal reasons or even simply receiving a better offer somewhere else. Why should the departing party leave with one-third of the Company’s shares, just before you even had a chance to do anything? This situation may cause a range of difficulties starting from making basic decisions in the company (trying to chase someone who is no longer an active part of the company but is still needed to vote in certain matters of the board or general meeting) to being unattractive to investors (trying to explain who the third person in the cap table is and why he is no longer with us but holds a third of the company’s share interest).

Having said that, promise yourself that when the time comes, you will be ready to let go of a fellow musketeer which turns out is not a good fit for the startup. I am not telling you this in order to scare you out of working with your fellow musketeers or embarking on your journey, but it's best to wrap your head around the basic and unfortunate notion that someone is bound to leave and that everyone is on the same page concerning this scenario.

On a practical level, there is a simple solution for all of this which is known as a “Reverse Vesting” or “Repurchase Right” clause in the founder's agreement. The concept of vesting for founders’ shares, is that they will receive or rather "earn" their shares over time. Although each will have the right to 100% of the shares upon incorporation, in the event they choose to leave before the determined vesting schedule, the company or the other founders shall have the “repurchase right” to purchase their shares (for a very symbolic consideration). The importance of setting this out so early on in time is to avoid any tax events that may occur later on due to the transfer of the shares, once the company has already gained certain value. Not to mention, this helps avoid unwanted disputes and claims from departing founders – since you all agreed on this from day one before the shares were had any real value.

The purpose is to provide each of the founders with an incentive to continue and help your startup succeed, and if not, keep the company safe from future deadlock. If a founder chooses to leave before his shares became fully vested according to the determined schedule, then accordingly, he or she shall leave with the number of shares he or she “deserves” for the time actually spent. The rest of the shares are then transferred back to the Company or pro-rata to the founders.

Standard vesting schedules are usually between 3-4 years and may or may not include a one-year “cliff” from the date of the agreement, which until then, none of the shares vest. If a cliff is included, then following the cliff, a certain portion -usually the pro-rata share of the time that passed out of the total period - vests, and thereafter, the remaining shares vest over the next 2-3 years, in a monthly or quarterly linear fashion. Should one of you leave along the way (who knows, maybe Google will poach you – hey, we get it, or maybe this just isn't your thing being an entrepreneur) the repurchase will be exercised, leaving you to peacefully back away from your shares, and make room for your successors.

There are different approaches to this matter, which differentiate based on the various reasons for the founder no longer being with us. We, however, would recommend the most aggressive reverse vesting scheme settled between you, so that if a founder leaves or is let go – for any reason whatsoever – the company or remaining shareholders can exercise the repurchase right and take your shares that have not yet vested. This means that no matter what horrible event occurred; the unvested shares are being returned. Why should you lose twice from a horrible situation in which one founder finds death or disability, and they receive another extra portion of shares (you are still stuck in a situation where he holds too much equity)? In another complex situation, the founder leaves as he feels like he is a fifth wheel and the other two are ganging up against him. In many ways may feel like he is being "bullied" professionally, and the other founders getting "extra" shares from him upon his departure is unfair. To that, we also say nay. He should return the rest of his shares. In our experience, if the reason for the departure of a founder has bearing on the number of shares he or she will remain with, this reason will be disputed in real-time and no path to a definitive outcome will be available for the company, which could lead to its demise. Having a clear-cut arrangement is in your favor. You need an easy and simple tool, to be able to save the surviving founders in this event, from any situation. This is truly the meaning of taking one for the team: a founder should be able to sincerely agree to move aside and sacrifice his or her equity if the time comes, for the sake of the company.

Also, general tip on a human factor level. Work on your character judgment and try exercising your emotional intelligence by recognizing the types of people you should work with, and others you should not.

And having said all of that, note that once you encounter your first investors, this agreement most likely is terminated or heavily amended. Thus, and mostly for the repurchase right we discussed above, there should be no reason not to execute the agreement and “forget about it” until (sadly) one of the musketeer's leaves, or (happily) when your investor requests to terminate it. As Alexandre Duma would conclude:

“And now, gentlemen […] All for one, one for all--that is our motto, is it not?”

“And yet--” said Porthos.

“Hold out your hand and swear!” cried Athos and Aramis at once.

Overcome by example, grumbling to himself, nevertheless, Porthos stretched out his hand, and the four friends repeated with one voice the formula dictated by d’Artagnan:

“All for one, one for all.”

“That’s well! Now let us everyone retire to his own home...”

The Founders Agreement is an important agreement that can have serious implications for the founders and the company's ability to grow and succeed. If you indeed intend on operating on an all for one, and one for all basis, we strongly recommend that you enter into a Founders Agreement before you embark on your adventure. You can find a template for such an agreement here. This template is offered as-is and does not constitute legal advice, and we strongly recommend that you consult with a lawyer before entering into a founders agreement.

Shine Shaham is an associate in Yigal Arnon & Co.’s high-tech practice. Shine's practice focuses on the representation of high-tech startup companies as well as established corporations, venture capital funds, private investors, technological incubators, and multinational companies, with an emphasis on private equity financings, commercial transactions, corporate governance, strategic investments and mergers, and acquisitions.