The Need for Speed: Startup Velocity

25.06.2020

Part A: Founders’ Perspective:

Consider a situation you know: A bunch of entrepreneurs (henceforth: the Founders) meet at a noisy café and discuss, for the first time, a disruptive idea worthwhile launching a startup upon.

These founders are serious: They have quit their day jobs to focus solely on their new venture, and boy! don’t they move fast…

They have started their product marketing effort, UX-UI is in the works, coding is being hammered on their keyboards. A dream team, there’s no denying.

They are pressing the pedal to the metal, and for a good reason, too.

Given their obvious talents and strengths, they are forgoing considerable amount of cash in salaries and benefits, for a prolonged period of time. Team members are pursued by head-hunters, and how long will they be able to fend them off, great vision and all?

Sacrificing income to pursue your dream is highly appreciated. Your life partner (now supporting you), parents, and banker are all for it — up to a point. However, you, and your supporting environment need strong signals that the risk you took will pay off.

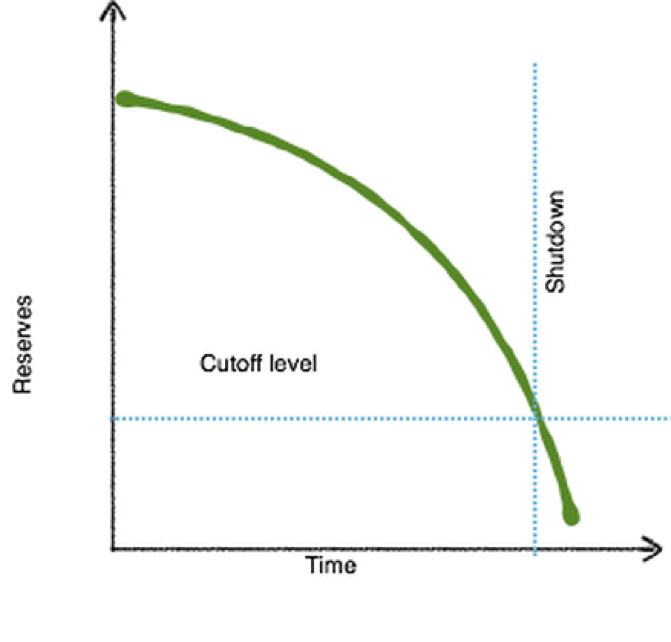

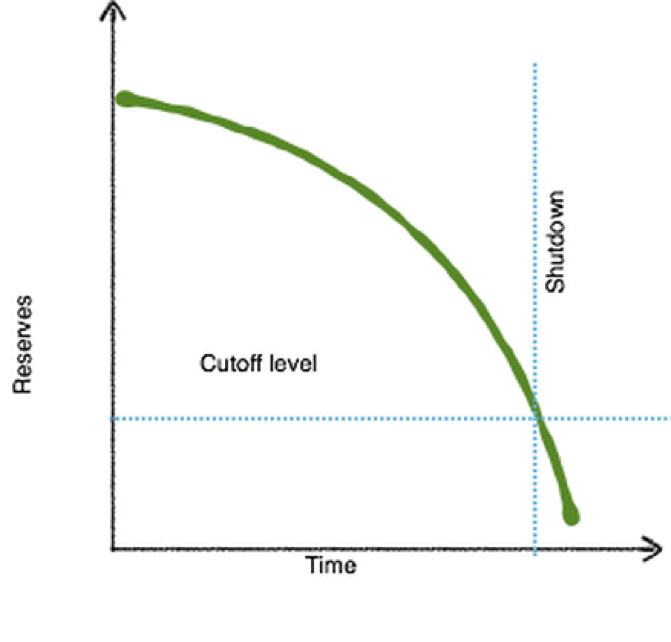

The forgone income is the founders’ alternative cost — and, as time goes by, it drains at an accelerating pace — together with confidence. At some point the founders’ financial reserves will be depleted, the pressures on the founding team mount to an unsustainable level, when a job offer or another distraction will break the pack apart.

Part B: Investors’ Perspective:

In a recent presentation by Gil Ben-Arzi, he stressed the need for start ups to aim high. The pattern emerges clear, at every funding stage: (venture) capitalists seek HUGE exits.

As they screen startups for investment, one of the most important things they are looking for, to validate and predict those fabled exits, is Speed, (AKA Momentum).

The Beauty Contest:

Consider two competing startups:

Both operated in the same industry for six to eight months , before applying for your money.

The first has already incorporated, and although their team is somewhat lacking (no CTO), they do have already a name, a registered domain and a landing page, a working MVP or even a growing user base.

The second startup has more in the bag when it comes to qualified founders, but their day jobs commitments are slowing them down, and — although they have an accomplished tech founder, they are still four weeks short of their initial launch. To prevent legal costs, they still have not incorporated.

All other things being equal, I find this scenario to be a “tough to call” situation. True, the first team is lacking in talent. But somehow, they managed to overcome this, and come with a host of tangible milestones — and resulting data allowing investors to analyze their market reception. The decision will be taken NOW. To me, the second startup is not yet in the game. They might never be, for that matter.

My preference, then, is clear: I go with the doers… Of course they lack, in a team of three, some crucial competences, but what they clearly have is the drive necessary to overcome these deficits, and the ability to deliver.

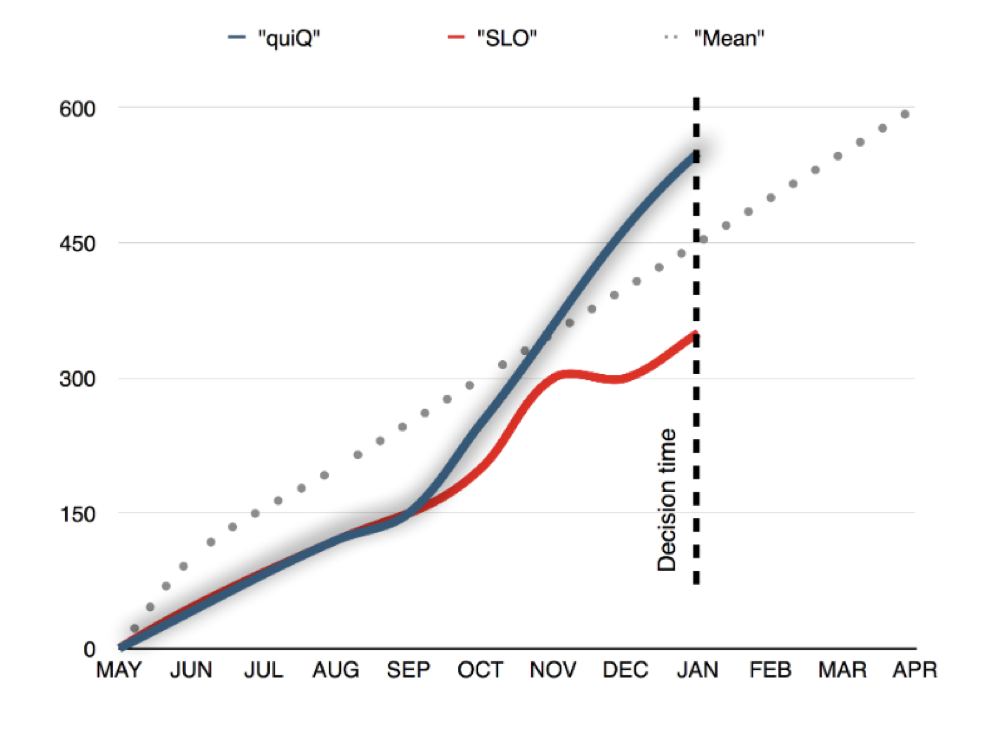

Comparative startup velocity

In each industry, investors observe a common trend of accruing value (depicted in the dotted line). Growing from nil to $600K. This value stems from the average funding obtain at seed stage, and from a set list of milestones achieved by most of the companies that did get investment.

Investors then compare prospective startups to the par, placing virtual value to each milestone (not unlike “Earned Value” method in project management).

Again, all other things being equal, where would you choose to put your money on?

That’s why speed is critical to Investors.

Yoel Frischoff is a consultant to Startups and technology companies, preparing them for growth and guides them through challenges.

Disclaimer:

This post is offered as education material only, and should not be construed as a concrete advice or consulting aimed at any specific situation. The reader shall bear all responsibility in making use of any of the ideas or techniques mentioned above.

Are you in need of in depth consulting and analysis?

I can be reached at yoel@theroadtlv.com

Consider a situation you know: A bunch of entrepreneurs (henceforth: the Founders) meet at a noisy café and discuss, for the first time, a disruptive idea worthwhile launching a startup upon.

These founders are serious: They have quit their day jobs to focus solely on their new venture, and boy! don’t they move fast…

They have started their product marketing effort, UX-UI is in the works, coding is being hammered on their keyboards. A dream team, there’s no denying.

They are pressing the pedal to the metal, and for a good reason, too.

Given their obvious talents and strengths, they are forgoing considerable amount of cash in salaries and benefits, for a prolonged period of time. Team members are pursued by head-hunters, and how long will they be able to fend them off, great vision and all?

Sacrificing income to pursue your dream is highly appreciated. Your life partner (now supporting you), parents, and banker are all for it — up to a point. However, you, and your supporting environment need strong signals that the risk you took will pay off.

The forgone income is the founders’ alternative cost — and, as time goes by, it drains at an accelerating pace — together with confidence. At some point the founders’ financial reserves will be depleted, the pressures on the founding team mount to an unsustainable level, when a job offer or another distraction will break the pack apart.

Part B: Investors’ Perspective:

In a recent presentation by Gil Ben-Arzi, he stressed the need for start ups to aim high. The pattern emerges clear, at every funding stage: (venture) capitalists seek HUGE exits.

As they screen startups for investment, one of the most important things they are looking for, to validate and predict those fabled exits, is Speed, (AKA Momentum).

The Beauty Contest:

Consider two competing startups:

Both operated in the same industry for six to eight months , before applying for your money.

The first has already incorporated, and although their team is somewhat lacking (no CTO), they do have already a name, a registered domain and a landing page, a working MVP or even a growing user base.

The second startup has more in the bag when it comes to qualified founders, but their day jobs commitments are slowing them down, and — although they have an accomplished tech founder, they are still four weeks short of their initial launch. To prevent legal costs, they still have not incorporated.

All other things being equal, I find this scenario to be a “tough to call” situation. True, the first team is lacking in talent. But somehow, they managed to overcome this, and come with a host of tangible milestones — and resulting data allowing investors to analyze their market reception. The decision will be taken NOW. To me, the second startup is not yet in the game. They might never be, for that matter.

My preference, then, is clear: I go with the doers… Of course they lack, in a team of three, some crucial competences, but what they clearly have is the drive necessary to overcome these deficits, and the ability to deliver.

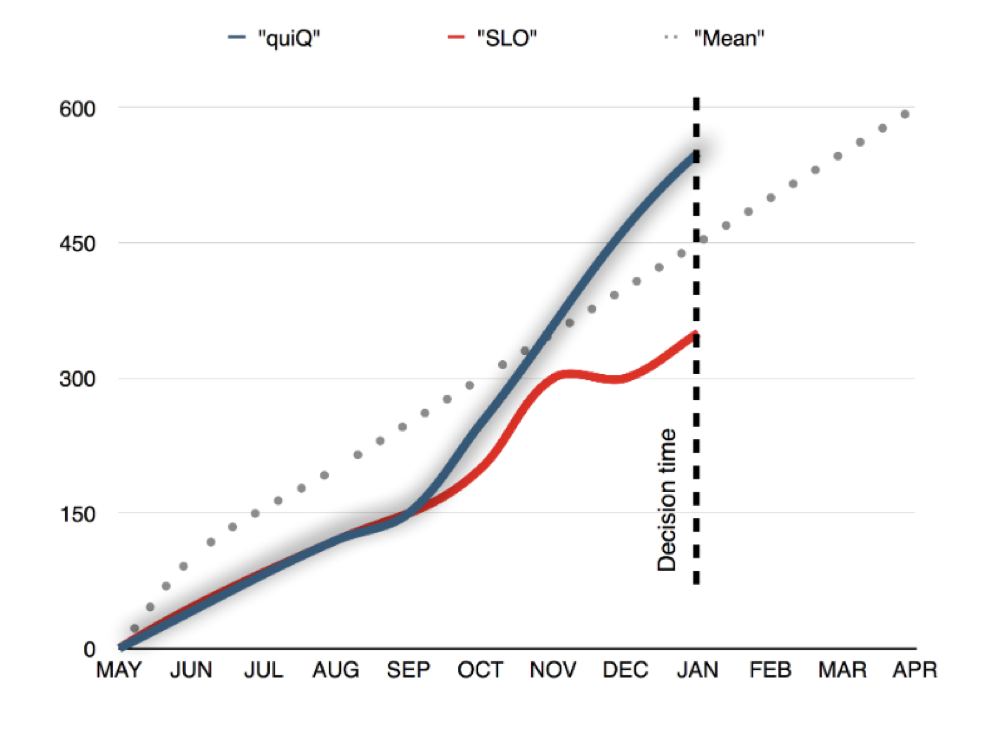

Comparative startup velocity

In each industry, investors observe a common trend of accruing value (depicted in the dotted line). Growing from nil to $600K. This value stems from the average funding obtain at seed stage, and from a set list of milestones achieved by most of the companies that did get investment.

Investors then compare prospective startups to the par, placing virtual value to each milestone (not unlike “Earned Value” method in project management).

Again, all other things being equal, where would you choose to put your money on?

That’s why speed is critical to Investors.

Yoel Frischoff is a consultant to Startups and technology companies, preparing them for growth and guides them through challenges.

Disclaimer:

This post is offered as education material only, and should not be construed as a concrete advice or consulting aimed at any specific situation. The reader shall bear all responsibility in making use of any of the ideas or techniques mentioned above.

Are you in need of in depth consulting and analysis?

I can be reached at yoel@theroadtlv.com