Budgeting and Cash Flows: The Basics

28.04.2019

Reading Time: 3 min.

When I’m not working, writing articles for this website, making (often vain) attempts to keep my garden alive, learning German or knitting, I volunteer with an organization called Paamonim. We work with families to teach them personal financial management skills. Anyway, this week my team leader had the team come in for a periodic meeting in which we bonded over tips and tricks in the personal financial counseling biz. Then she asked a question: what is the difference between a budget and a cash flow?

Dead silence.

And then I spoke up.

Simple! A budget is WHAT. A cash flow is WHEN.

Bingo!

Let’s review that again.

A budget is WHAT.

A cash flow is WHEN.

A budget is how much money you are earning and how it is being earned and how much money you are spending and on what you are spending it. A cash flow is when that money is coming in or going out. The two are not identical and forgetting this can mean that you have a lot of bills to pay and no money to pay them with.

Honestly, that’s still not really clear

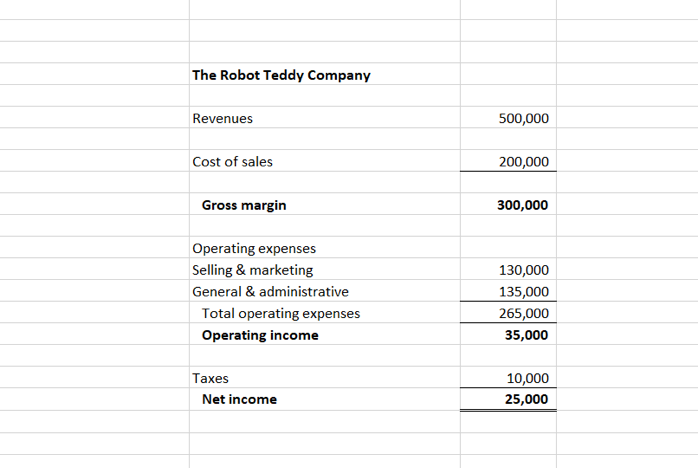

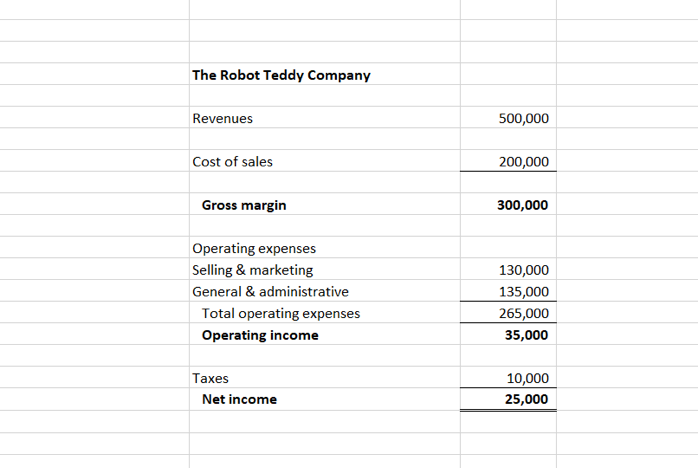

So let me give you an example. Imagine you have a company that sells…thinking here…robot teddy bears. You have the bears manufactured in China, ship them to your home country and sell them. And they are leaping off the shelves! At the end of the year, your annual profit & loss statement looked a bit like this.

You have a net profit of 25,000. Not bad, though why anyone would want to buy metallic non-cuddly teddy bears is beyond me. But never mind that! Net profit means you are, well, profitable! Which means you can pay your bills and stay in business! Right?

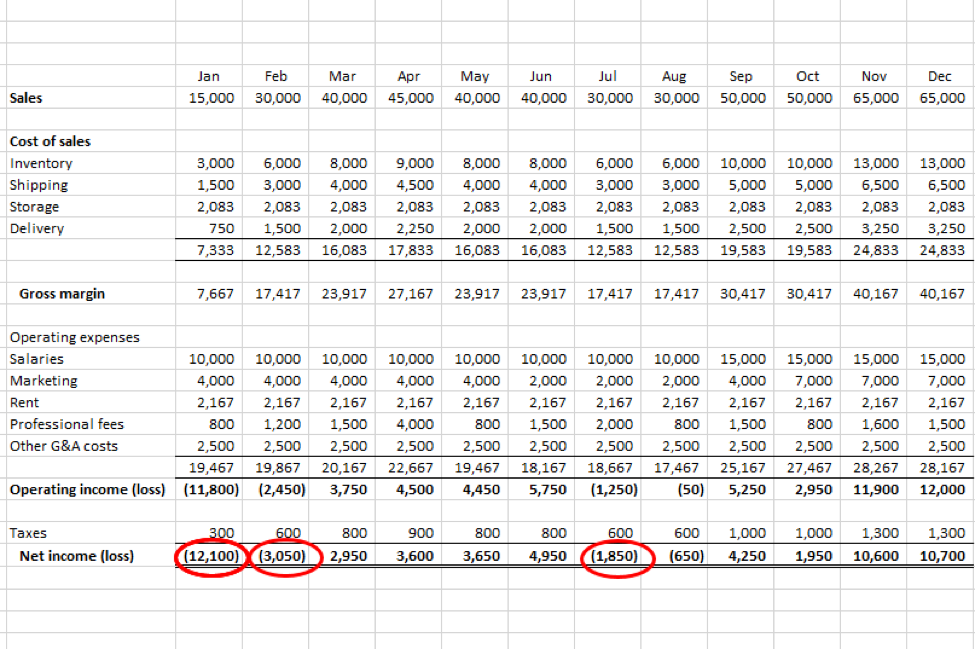

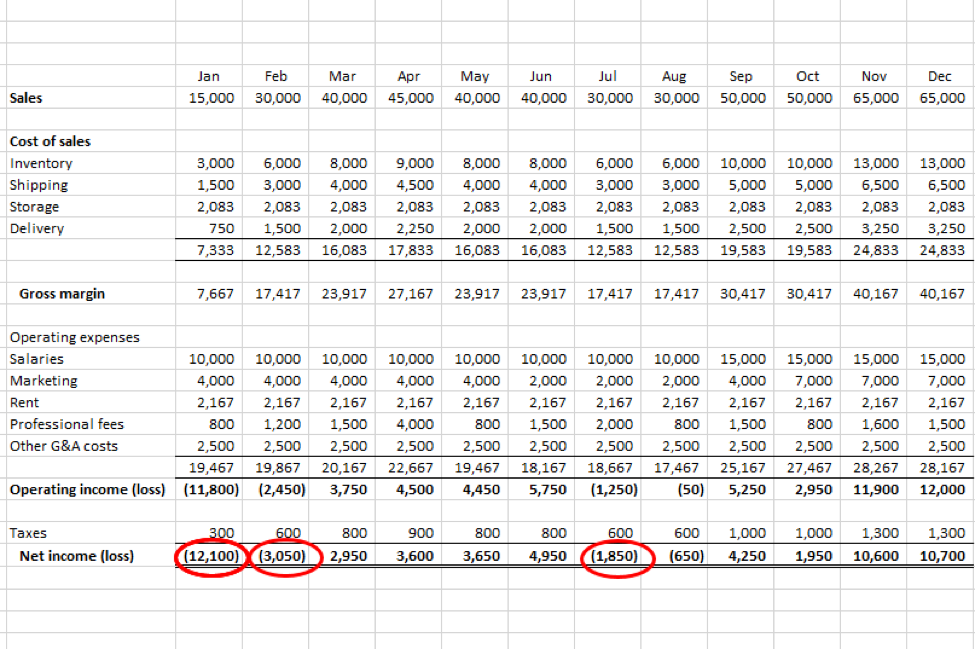

Hmmm….let’s drill down a bit into that revenue and expenses. This is what your P&L looks like on a monthly basis, and with a bit more detail.

(No, these numbers are not intended to be an even slightly realistic depiction of a robotic teddy bear company’s expected costs. It’s 10 PM, it’s been a long day, and I’m just picking stuff out of the air. )

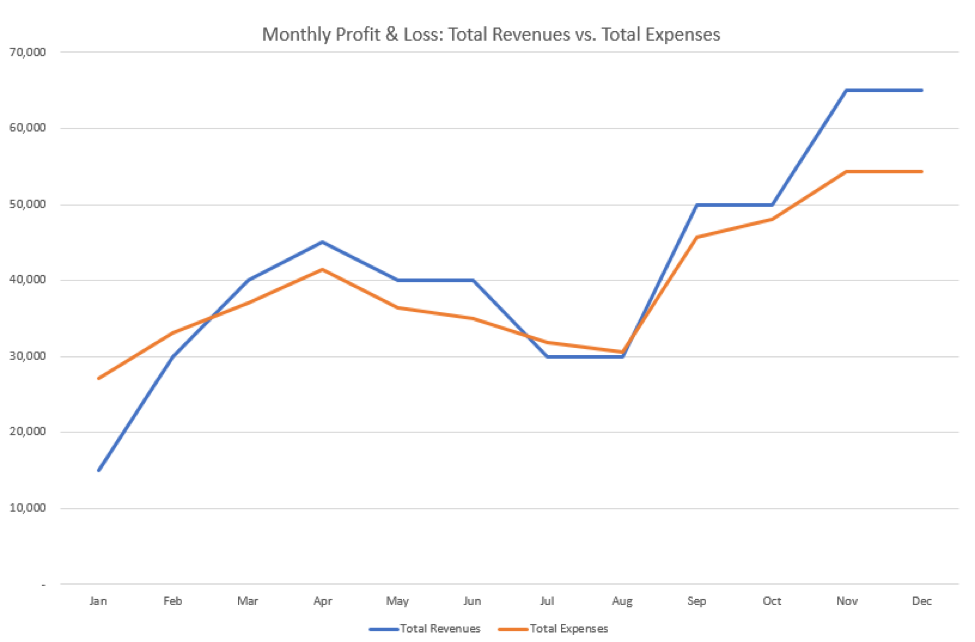

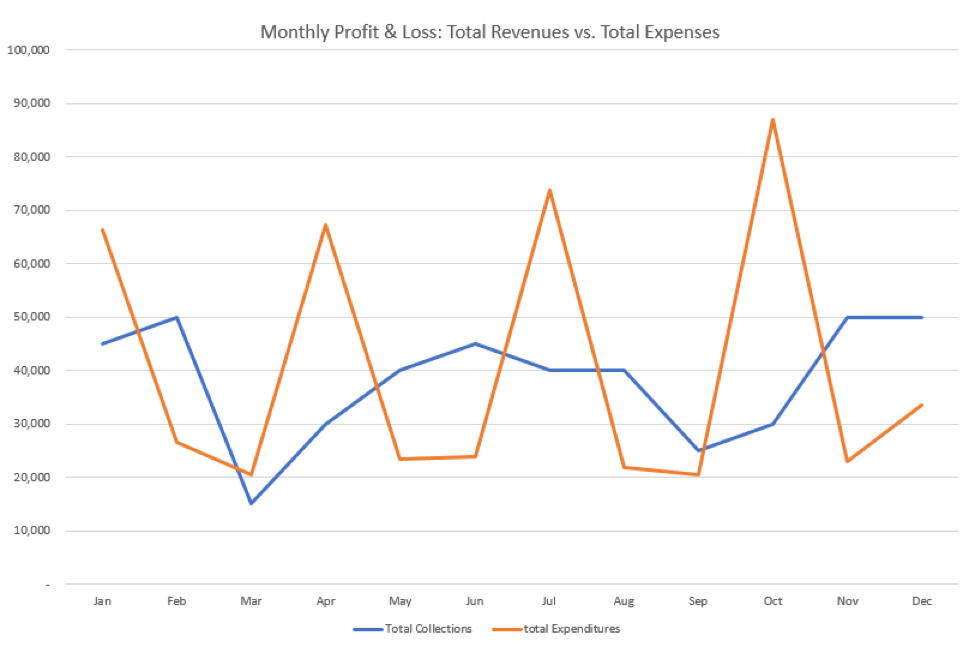

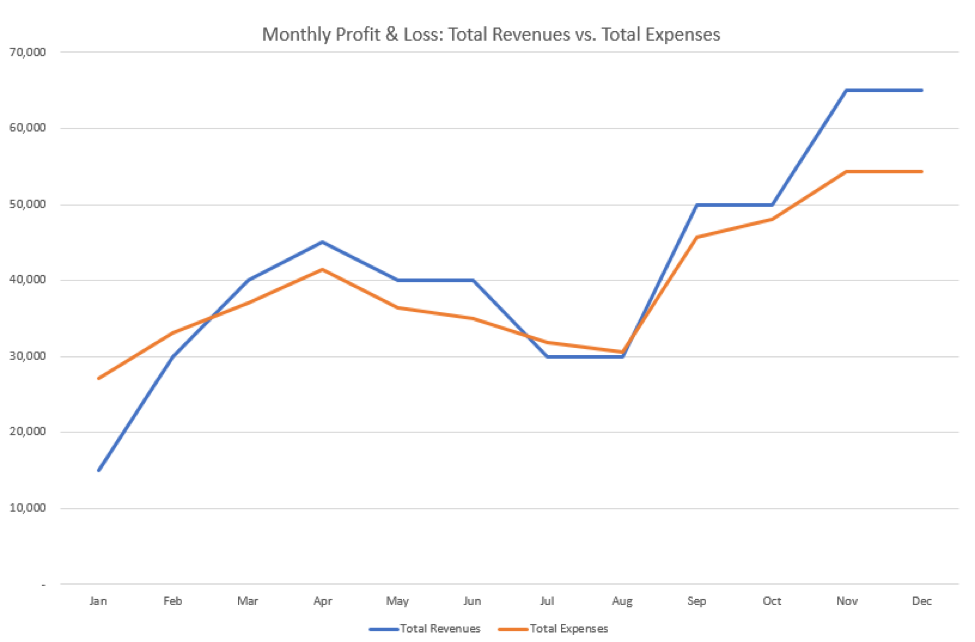

And the above in graph form:

Now, as you can see, while there are a few months in which the sales are weaker (post-Christmas, summer holidays) and in these months, expenses exceed revenues. But these deficits are generally manageable and in most months—and overall—the business is in the black.

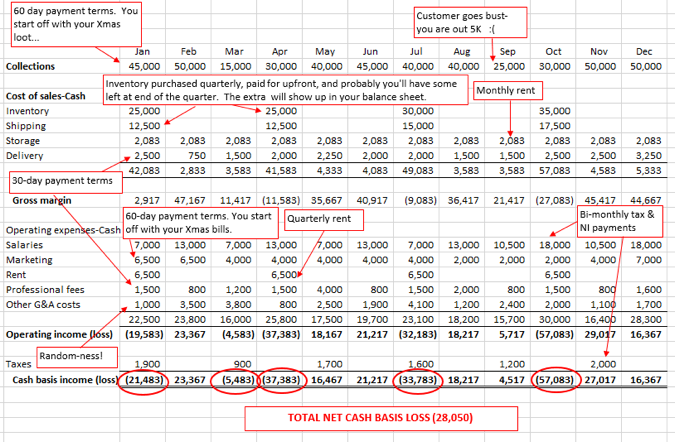

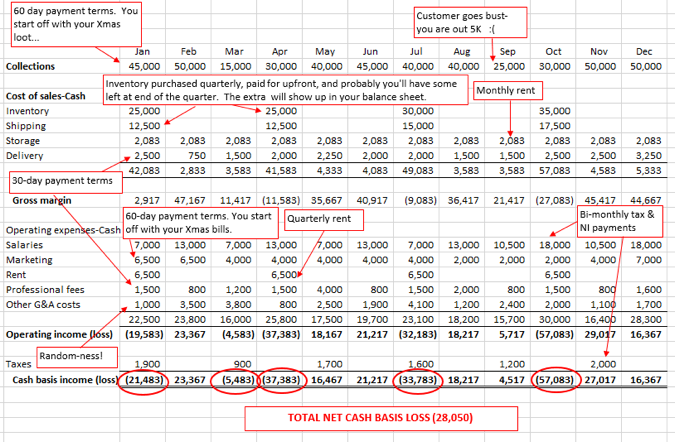

But…that’s still just the budget. What happens when we look at cash?

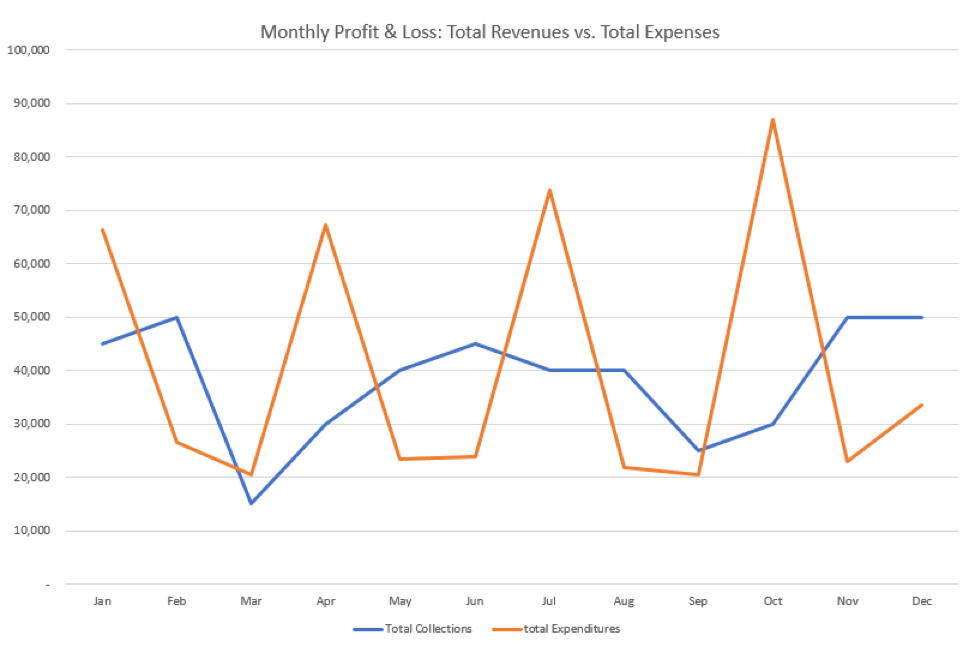

And this graph?

Massive peaks and valleys. Massive deficits five months out of twelve. And an overall deficit of 28K. I hope you have some financing lined up to tide you over!

Moral of the story? It is not enough to know what. You also have to know when.

Okay, I get that this is important! But how do I even track this in my budget?

Recently I worked with a founder on just that issue. He had attended a presentation I had given on business budgeting basics, and so he knew that tracking cash balances was critical. He asked me to help him incorporate a schedule tracking cash balances into his file. I was happy to oblige and together we added a cash flow schedule to his file. He was pleasantly surprised to see how simple it is. Cash flows are the type of things that, once they are explained, they just seem intuitive.

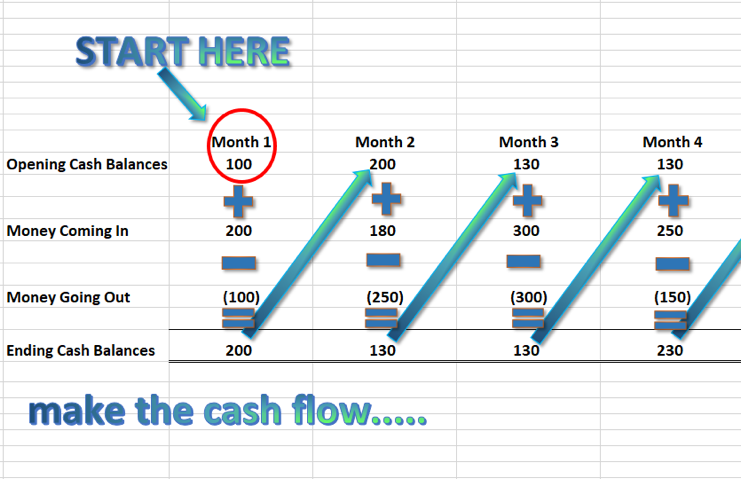

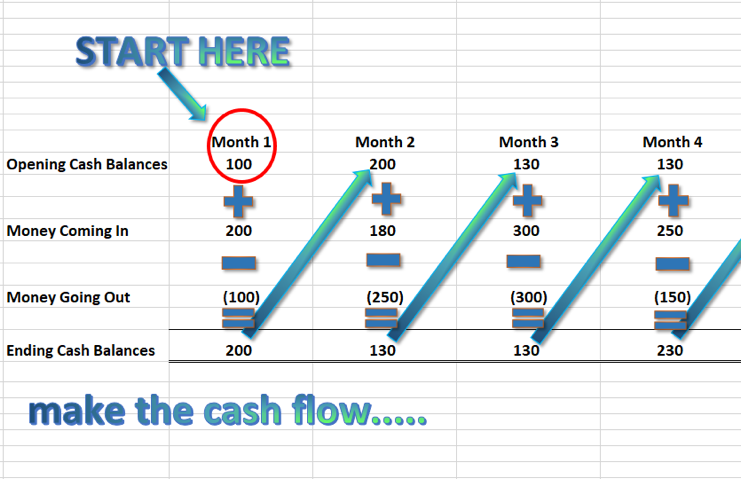

Here is how it works in general:

Opening Cash Balances + Money Coming In – Money Going Out = Ending Cash Balances.

Or, if we are looking on a monthly basis:

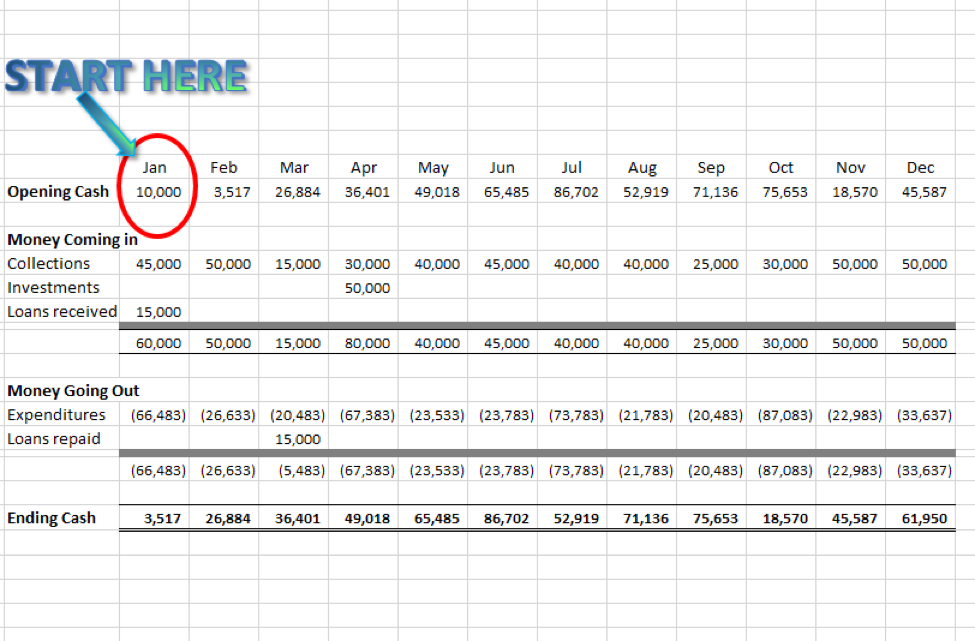

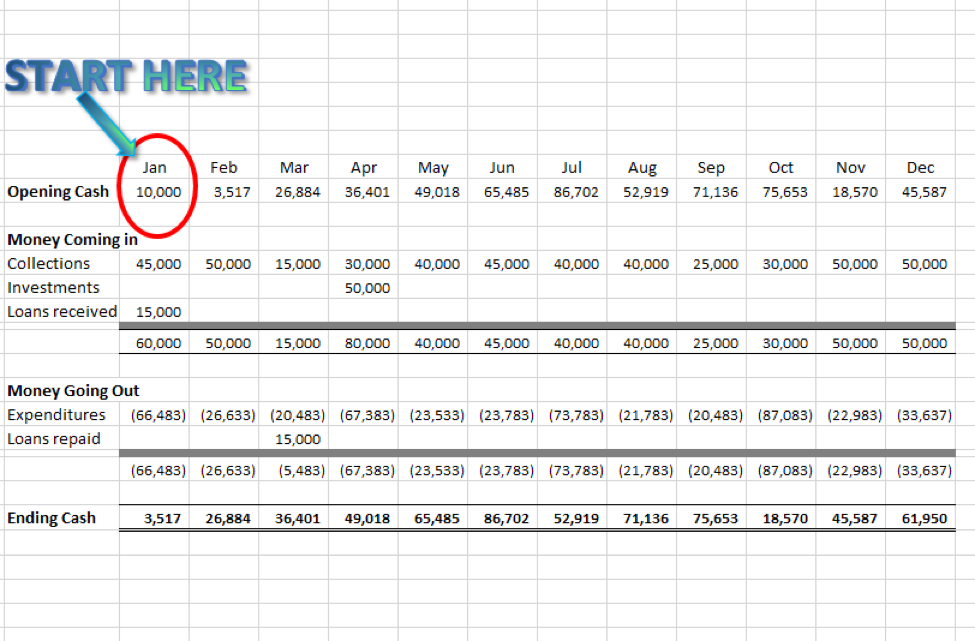

Or if we take our Robot Teddy Bears example above:

All you need to do is pull the relevant information in from the other pages in your budget. In this example, we can see that if the Company can get some debt or investment financing into place, it can ride through the cash peaks and valleys.

Gila Halleli Weiss, Accountant and advisor to startups with 21 years’ experience. A dual-certified CPA (Israel & the US). In addition to serving as CFO of mySupermarket I serve as an advisor to startups via my website, CFO Secrets , as an outsource CFO for an early-stage startup and as a mentor and lecturer for MassChallenge.

When I’m not working, writing articles for this website, making (often vain) attempts to keep my garden alive, learning German or knitting, I volunteer with an organization called Paamonim. We work with families to teach them personal financial management skills. Anyway, this week my team leader had the team come in for a periodic meeting in which we bonded over tips and tricks in the personal financial counseling biz. Then she asked a question: what is the difference between a budget and a cash flow?

Dead silence.

And then I spoke up.

Simple! A budget is WHAT. A cash flow is WHEN.

Bingo!

Let’s review that again.

A budget is WHAT.

A cash flow is WHEN.

A budget is how much money you are earning and how it is being earned and how much money you are spending and on what you are spending it. A cash flow is when that money is coming in or going out. The two are not identical and forgetting this can mean that you have a lot of bills to pay and no money to pay them with.

Honestly, that’s still not really clear

So let me give you an example. Imagine you have a company that sells…thinking here…robot teddy bears. You have the bears manufactured in China, ship them to your home country and sell them. And they are leaping off the shelves! At the end of the year, your annual profit & loss statement looked a bit like this.

You have a net profit of 25,000. Not bad, though why anyone would want to buy metallic non-cuddly teddy bears is beyond me. But never mind that! Net profit means you are, well, profitable! Which means you can pay your bills and stay in business! Right?

Hmmm….let’s drill down a bit into that revenue and expenses. This is what your P&L looks like on a monthly basis, and with a bit more detail.

(No, these numbers are not intended to be an even slightly realistic depiction of a robotic teddy bear company’s expected costs. It’s 10 PM, it’s been a long day, and I’m just picking stuff out of the air. )

And the above in graph form:

Now, as you can see, while there are a few months in which the sales are weaker (post-Christmas, summer holidays) and in these months, expenses exceed revenues. But these deficits are generally manageable and in most months—and overall—the business is in the black.

But…that’s still just the budget. What happens when we look at cash?

And this graph?

Massive peaks and valleys. Massive deficits five months out of twelve. And an overall deficit of 28K. I hope you have some financing lined up to tide you over!

Moral of the story? It is not enough to know what. You also have to know when.

Okay, I get that this is important! But how do I even track this in my budget?

Recently I worked with a founder on just that issue. He had attended a presentation I had given on business budgeting basics, and so he knew that tracking cash balances was critical. He asked me to help him incorporate a schedule tracking cash balances into his file. I was happy to oblige and together we added a cash flow schedule to his file. He was pleasantly surprised to see how simple it is. Cash flows are the type of things that, once they are explained, they just seem intuitive.

Here is how it works in general:

Opening Cash Balances + Money Coming In – Money Going Out = Ending Cash Balances.

Or, if we are looking on a monthly basis:

Or if we take our Robot Teddy Bears example above:

All you need to do is pull the relevant information in from the other pages in your budget. In this example, we can see that if the Company can get some debt or investment financing into place, it can ride through the cash peaks and valleys.

Gila Halleli Weiss, Accountant and advisor to startups with 21 years’ experience. A dual-certified CPA (Israel & the US). In addition to serving as CFO of mySupermarket I serve as an advisor to startups via my website, CFO Secrets , as an outsource CFO for an early-stage startup and as a mentor and lecturer for MassChallenge.