Fund Raising Trends in Israel

24.03.2019

Over the the last 4 years, S-Cube has been conducting the only survey in Israel that is based on accurate data (from actual investment agreements), of over 400 capital financing rounds of Israeli start-up companies that are among S-Cube's clients. In our series of articles, we will present the data gathered from the survey. In the current article, we will discuss raising capital trends.

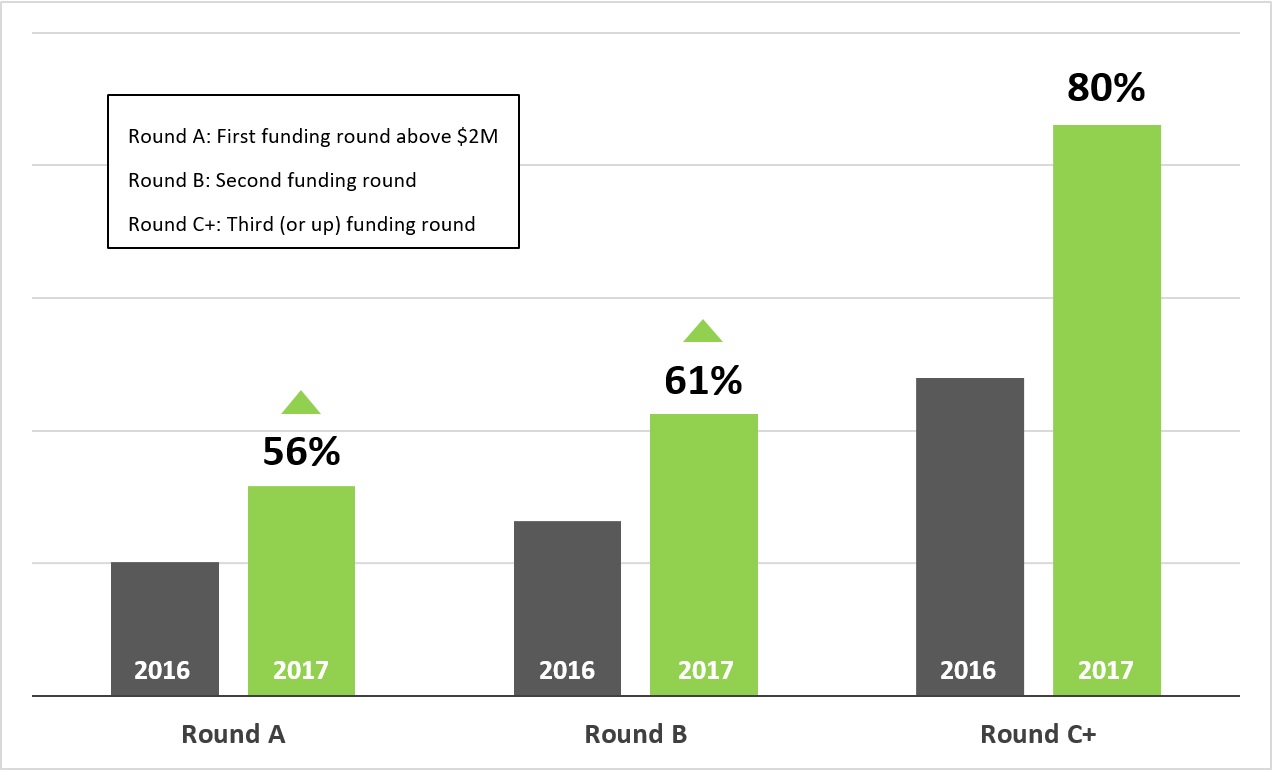

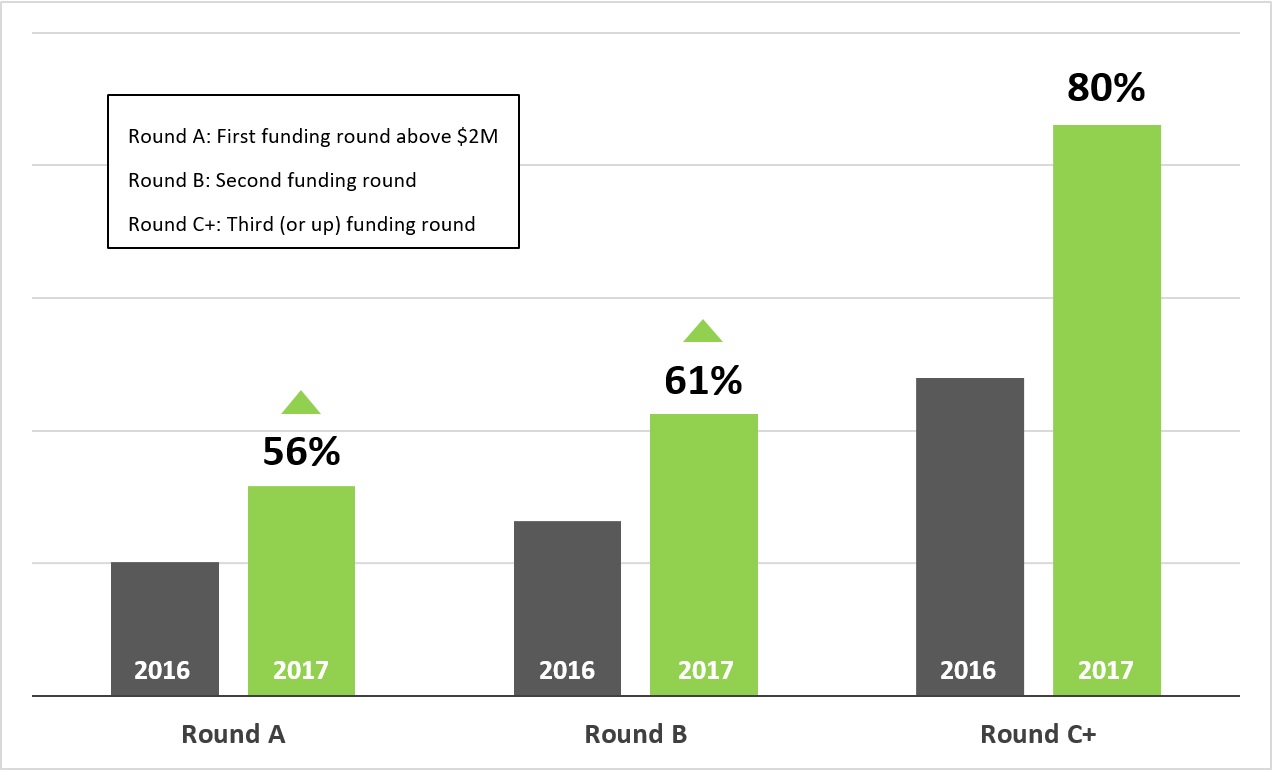

S-Cube's survey indicated that during 2017 there was a significant increase in the value of companies. The amounts raised in 2017 have significantly increased regardless of company’s stage, as compared to 2016, between 56% to 80%, as can be seen in the graph below:

When analyzing the findings, we believe that the increase in the amounts raised in recent years is due mainly to the desire of start-up companies to grow and become a mature company. These days, companies are not “rushing” to exit - they’re interested in continuing their development process, grow organically or by M&A acquiring competing companies and becoming robust and meaningful companies on their own. The growing popularity of secondary deals over the past years supports this and enables "mini" exits for the founders and seed investors and by that delays their desire for a quick exit.

Another trend found in the survey, which has gained momentum in recent years, is the transition in funding model, from participating shares liquidation rights to non-participating shares, from non-participating represents about 30% of the investments in 2013 to about 60% in 2017. This significantly changes the distribution during a liquidity event between the founders and the investors.

The non-participating shares is a model that benefits the ordinary shareholders - the founders and employees (as well as seed investors). In this model, the shareholders will not participate in the distribution with the ordinary shareholders after receiving their liquidation preference Moreover, the preferred shareholders have the right to convert their shares into ordinary shares and participate pro rata with the other shares, if this would result is a higher distribution amount. Conversely, participating shares are beneficial to the owners of the preferred shareholders - VC funds, institutional investors and so forth. In this type of model, after receiving their liquidation preference, the preferred shareholders will continue to participate in the distribution of funds based on their pro rata share with the rest of the shareholders of the company.

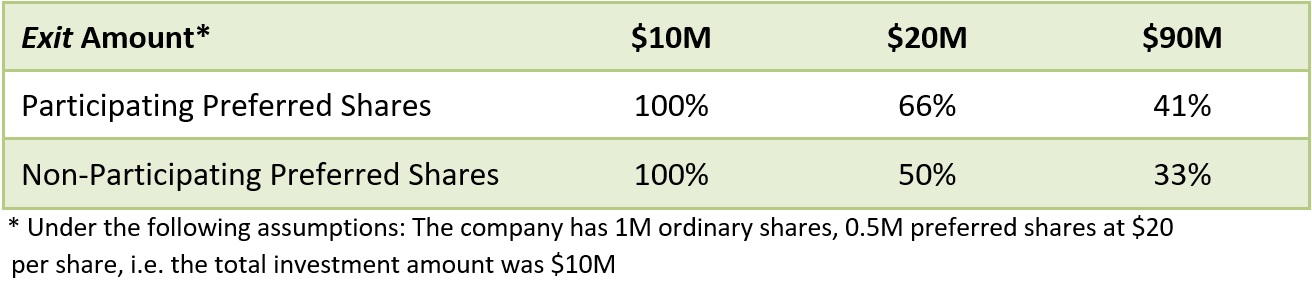

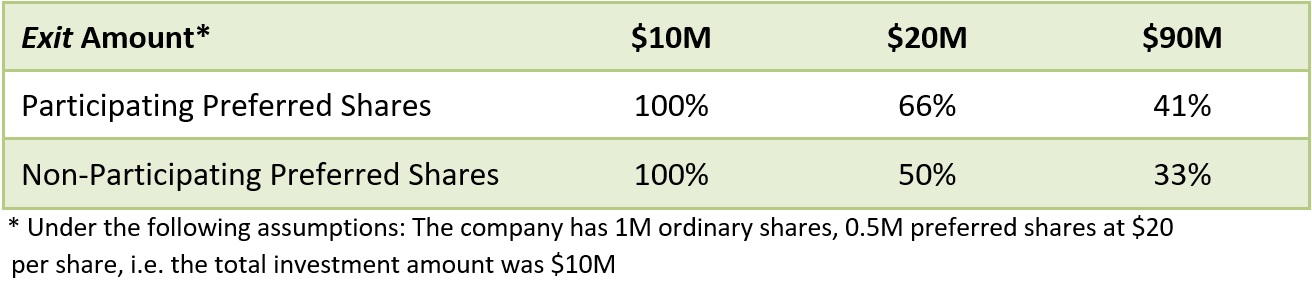

For example, the table below demonstrates the differences in the distribution (in percentages) between the two models, according to the exit amounts of $10M, $20M and $90M:

We can see that choosing a participating model versus non-participating drastically changes the amount that the shareholders will receive at a liquidity event (exit). When the exit amount is equal to or lower than the investment amount, then there is no difference between the two models. However, when the exit amount is above the investment amount, the participating preferred shares will always receive a higher distribution than the non-participating preferred shares.

In Israel, following the same trend in the US, there has been a trend inversion over the past three years and today the widespread model is non-participating, as opposed to the beginning of the decade. When examining researches that have been conducted in the US, it seems that choosing the participating model is mainly widespread with companies that are struggling, missing their targets or in order for VC funds to minimize the risk of the investment. It should be noted that in significantly high exit amounts (as compared to the investment amount in the company), the difference between the two models for the investors is negligible.

What’s next? In the next article, How much company can I buy for $1M?, S-Cube will present founders and investors with reliable and valuable information for Israeli start-ups: average investment amounts, % holdings according to the investment round and more.

Hebrew Version :

https://s-cube.co.il/s-cube-article-fund-raising-trends-in-israel/

Prior to founding S-Cube, one of the leading valuation firms in Israel, Gidi founded several startup technology companies, hence his background has positioned him and S-Cube at the unique standpoint of having both the valuation and economic background together with real, hands-on experience in managing companies and raising fund as well as M&A.

S-Cube's survey indicated that during 2017 there was a significant increase in the value of companies. The amounts raised in 2017 have significantly increased regardless of company’s stage, as compared to 2016, between 56% to 80%, as can be seen in the graph below:

When analyzing the findings, we believe that the increase in the amounts raised in recent years is due mainly to the desire of start-up companies to grow and become a mature company. These days, companies are not “rushing” to exit - they’re interested in continuing their development process, grow organically or by M&A acquiring competing companies and becoming robust and meaningful companies on their own. The growing popularity of secondary deals over the past years supports this and enables "mini" exits for the founders and seed investors and by that delays their desire for a quick exit.

Another trend found in the survey, which has gained momentum in recent years, is the transition in funding model, from participating shares liquidation rights to non-participating shares, from non-participating represents about 30% of the investments in 2013 to about 60% in 2017. This significantly changes the distribution during a liquidity event between the founders and the investors.

The non-participating shares is a model that benefits the ordinary shareholders - the founders and employees (as well as seed investors). In this model, the shareholders will not participate in the distribution with the ordinary shareholders after receiving their liquidation preference Moreover, the preferred shareholders have the right to convert their shares into ordinary shares and participate pro rata with the other shares, if this would result is a higher distribution amount. Conversely, participating shares are beneficial to the owners of the preferred shareholders - VC funds, institutional investors and so forth. In this type of model, after receiving their liquidation preference, the preferred shareholders will continue to participate in the distribution of funds based on their pro rata share with the rest of the shareholders of the company.

For example, the table below demonstrates the differences in the distribution (in percentages) between the two models, according to the exit amounts of $10M, $20M and $90M:

We can see that choosing a participating model versus non-participating drastically changes the amount that the shareholders will receive at a liquidity event (exit). When the exit amount is equal to or lower than the investment amount, then there is no difference between the two models. However, when the exit amount is above the investment amount, the participating preferred shares will always receive a higher distribution than the non-participating preferred shares.

In Israel, following the same trend in the US, there has been a trend inversion over the past three years and today the widespread model is non-participating, as opposed to the beginning of the decade. When examining researches that have been conducted in the US, it seems that choosing the participating model is mainly widespread with companies that are struggling, missing their targets or in order for VC funds to minimize the risk of the investment. It should be noted that in significantly high exit amounts (as compared to the investment amount in the company), the difference between the two models for the investors is negligible.

What’s next? In the next article, How much company can I buy for $1M?, S-Cube will present founders and investors with reliable and valuable information for Israeli start-ups: average investment amounts, % holdings according to the investment round and more.

Hebrew Version :

https://s-cube.co.il/s-cube-article-fund-raising-trends-in-israel/

Prior to founding S-Cube, one of the leading valuation firms in Israel, Gidi founded several startup technology companies, hence his background has positioned him and S-Cube at the unique standpoint of having both the valuation and economic background together with real, hands-on experience in managing companies and raising fund as well as M&A.