Preferred Shares - and the Preferred Rights they grant Investors

08.07.2018

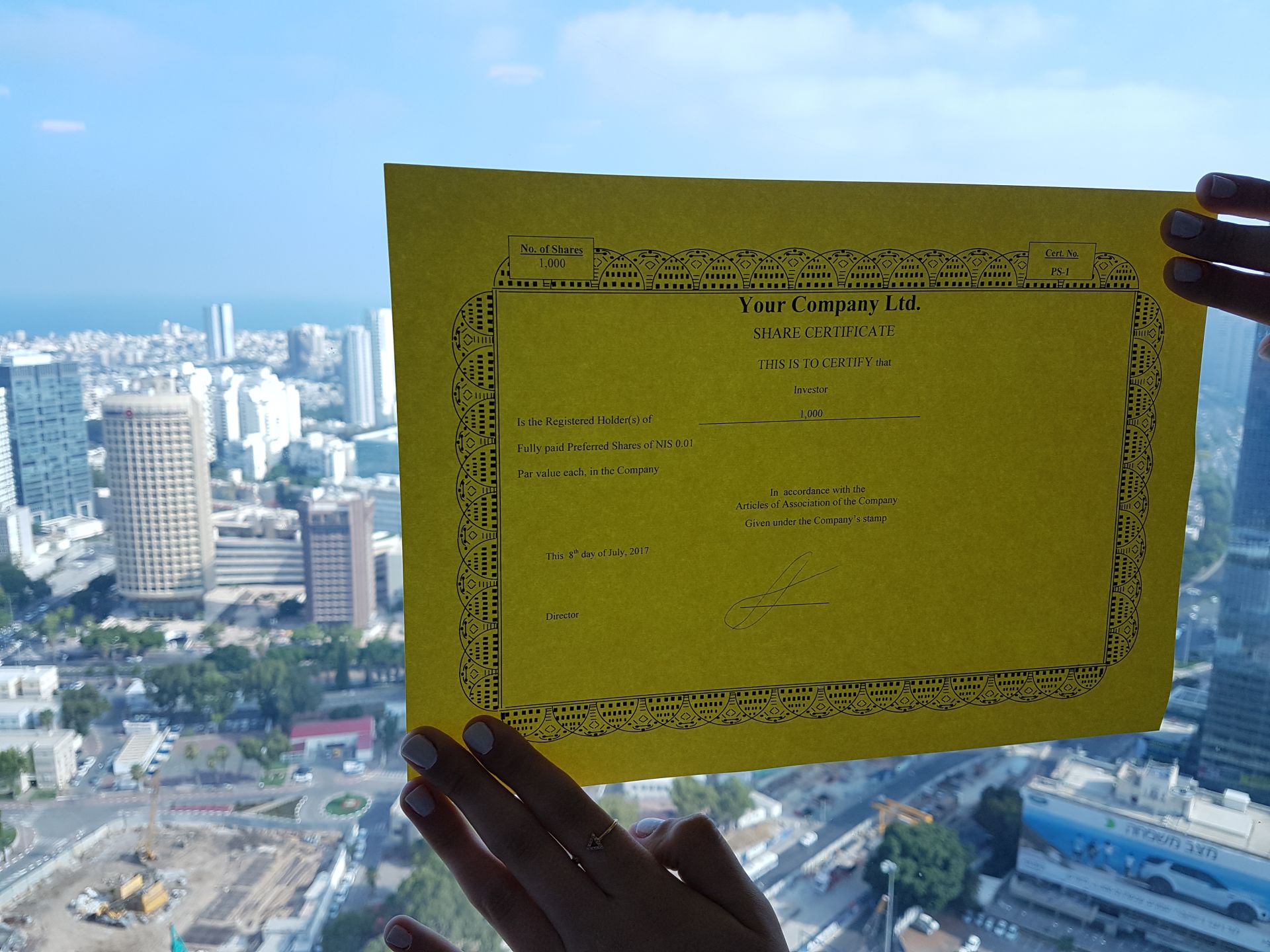

A share is a security which grants ownership in a portion of a company, the right to vote in shareholder meetings, and the right to participate in the distribution of dividends.

In the beginning, most companies grant founders - being the first shareholders in the company - one class of shares, ordinary shares. However there is another class of shares - a class which companies often issue to investors, and which include a long list of rights. These shares are known as preferred shares, and It is common for the rights which are attached to preferred shares to set in the company's Articles of Association, in the framework of negotiations ahead of an investment.

Here are a few of the rights which are granted to the holders of preferred shares:

Liquidation Preference - meaning, the investor will receive his investment back, or sometimes a higher, agreed-upon, amount, before the distribution to ordinary shareholders. (There are variations to this right, with the differences being significant. For more on this read "Cap Table").

Anti-Dilution Protection - this grants the investor the right to receive a retroactive compensation in the event that the company is forced to grant additional preferred shares in the future at a cheaper price than the price that the investor paid. In other words, compensation for an overly-expensive purchase. In most transactions the compensation is based off of the weighted of the high price paid for the preferred shares and the lower price paid for the new shares.

Veto Rights or Minority Protections - Investors usually purchase less than half of the shares of the company, which turns them into minority shareholders who are unable to block actions which the company is interested in carry out, but they investors are not. In order to have an effect on the day-to-day management of the company, attached to the preferred shares are rights which grant an increased control. In the framework of this right, investors set a list of decisions which cannot be approved without the consent of a special majority of the preferred shares. In addition, the investors usually attach the right to appoint a director to the preferred shares.

Information Rights - Many investors make sure that the preferred shareholders receive information from the company on a regular basis and in increased amounts relative to the default set by law. So, if the Companies Law ensures that shareholders receive annual audited financial statements, preferred shareholder often request quarterly financial statements, monthly updates from company management, and more.

Additional Economic Rights - There are a number of additional rights discussed in the course of rounds of financing, but they may be granted to ordinary shareholders, as well. The bottom line of these rights is the protection of percentage of holdings in the company, or to prevent the entrance of unwanted new partners.

Preemptive Rights - The company offers its existing shareholders the right to participate in rounds of equity financing in exchange for an additional investment.

Right of First Refusal - a shareholder who is interested in selling his shares must first offer them to the remaining shareholders in the company (and on the same terms), and notify them as to the identity of the potential purchaser of the shares.

Co-Sale/Tag Along - a shareholders who is interested in selling his shares, must allow the other shareholders in the company to sell shares on the same terms, and in proportion to their holdings in the Company.

The forgoing is general knowledge and does not constitute legal advice.

Nimrod Vromen is a Partner at Yigal Arnon & Co. with 10 years of experience in representing Startups, and is CEO of YTech Runway Ltd.

In the beginning, most companies grant founders - being the first shareholders in the company - one class of shares, ordinary shares. However there is another class of shares - a class which companies often issue to investors, and which include a long list of rights. These shares are known as preferred shares, and It is common for the rights which are attached to preferred shares to set in the company's Articles of Association, in the framework of negotiations ahead of an investment.

Here are a few of the rights which are granted to the holders of preferred shares:

Liquidation Preference - meaning, the investor will receive his investment back, or sometimes a higher, agreed-upon, amount, before the distribution to ordinary shareholders. (There are variations to this right, with the differences being significant. For more on this read "Cap Table").

Anti-Dilution Protection - this grants the investor the right to receive a retroactive compensation in the event that the company is forced to grant additional preferred shares in the future at a cheaper price than the price that the investor paid. In other words, compensation for an overly-expensive purchase. In most transactions the compensation is based off of the weighted of the high price paid for the preferred shares and the lower price paid for the new shares.

Veto Rights or Minority Protections - Investors usually purchase less than half of the shares of the company, which turns them into minority shareholders who are unable to block actions which the company is interested in carry out, but they investors are not. In order to have an effect on the day-to-day management of the company, attached to the preferred shares are rights which grant an increased control. In the framework of this right, investors set a list of decisions which cannot be approved without the consent of a special majority of the preferred shares. In addition, the investors usually attach the right to appoint a director to the preferred shares.

Information Rights - Many investors make sure that the preferred shareholders receive information from the company on a regular basis and in increased amounts relative to the default set by law. So, if the Companies Law ensures that shareholders receive annual audited financial statements, preferred shareholder often request quarterly financial statements, monthly updates from company management, and more.

Additional Economic Rights - There are a number of additional rights discussed in the course of rounds of financing, but they may be granted to ordinary shareholders, as well. The bottom line of these rights is the protection of percentage of holdings in the company, or to prevent the entrance of unwanted new partners.

Preemptive Rights - The company offers its existing shareholders the right to participate in rounds of equity financing in exchange for an additional investment.

Right of First Refusal - a shareholder who is interested in selling his shares must first offer them to the remaining shareholders in the company (and on the same terms), and notify them as to the identity of the potential purchaser of the shares.

Co-Sale/Tag Along - a shareholders who is interested in selling his shares, must allow the other shareholders in the company to sell shares on the same terms, and in proportion to their holdings in the Company.

The forgoing is general knowledge and does not constitute legal advice.

Nimrod Vromen is a Partner at Yigal Arnon & Co. with 10 years of experience in representing Startups, and is CEO of YTech Runway Ltd.